Why options trading has seen a massive rise in India, as explained by Zerodha CEO Nithin Kamath. Learn about market trends, risks, the future outlook and why options trading boom in India.

Table of Contents

Why Options Trading Boom in India

India has witnessed an explosive rise in options trading, especially among young retail investors. According to Zerodha CEO Nithin Kamath, this surge is driven by multiple factors including access to low-cost trading platforms, increased financial awareness, and social media influence.

What is Options Trading?

Options are a type of derivative contract that give investors the right (but not the obligation) to buy or sell an asset at a specific price before a set date. In India, Nifty and Bank Nifty options are among the most traded instruments on the NSE (National Stock Exchange).

Behind the Boom in Options Trading

1. Low Capital Requirement

Options allow traders to control large amounts of stock with relatively low capital. This appeals to small investors who may not have huge funds but want to benefit from market moves.

2. High Leverage and Quick Returns

With the potential for high returns in a short time, options trading attracts risk-takers. However, this also increases the risk of loss.

3. Ease of Access to Trading Platforms

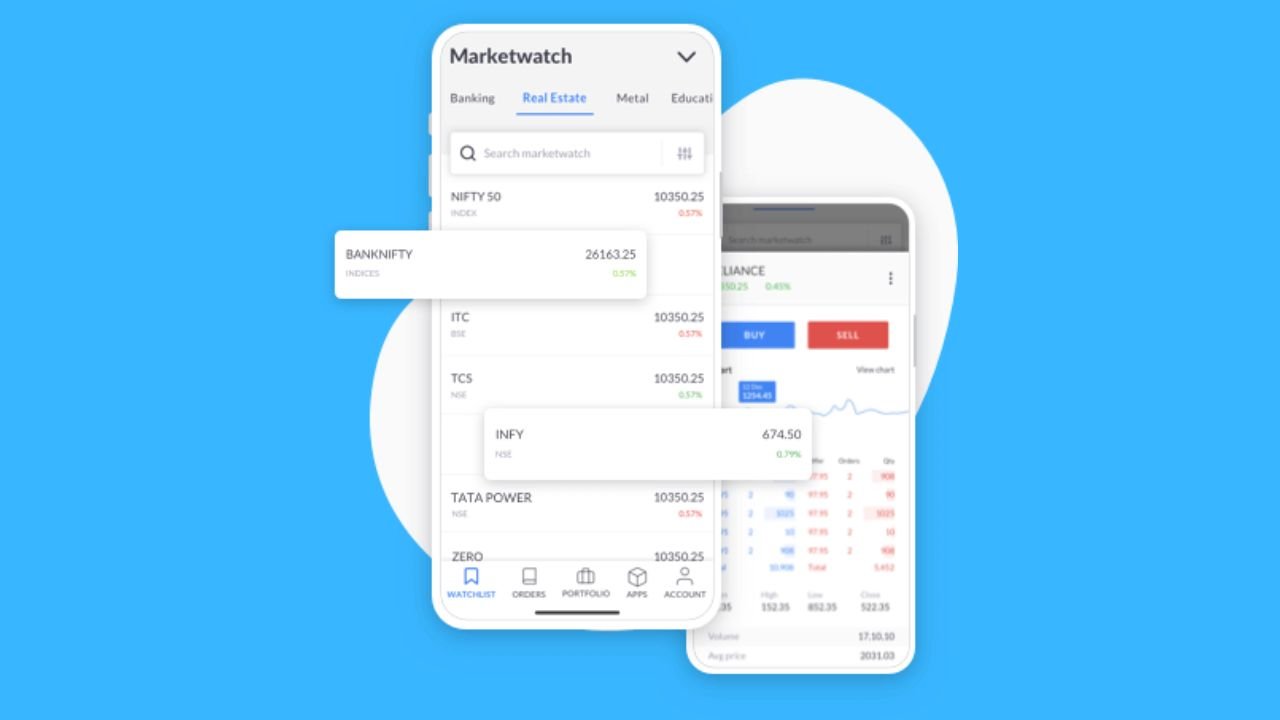

Online discount brokers like Zerodha, Groww, and Alice Blue have simplified trading for the average Indian. Mobile apps make it easy to place trades from anywhere.

4. Social Media Influence

Financial influencers and YouTube traders have glamorized options trading, sometimes misleading people with “get-rich-quick” strategies. Kamath has warned users to be cautious of such content.

5. Low Brokerage Fees

Brokerage firms now offer zero or low-cost trading, making it financially easier for traders to enter and exit the market frequently.

Nithin Kamath Says

In his statements and blog posts, Nithin Kamath has expressed concern over the growing obsession with short-term profits. He said,

“Many young traders are entering the market without understanding the risks. We need to focus more on education and risk management.”

He added that while it’s encouraging to see increased participation, the real challenge lies in making sure this trend doesn’t lead to large-scale retail losses.

Also Read

- Anurag Dwivedi Net Worth and Lifestyle in 2025 – YouTube, Fantasy Sports & More

- Why Options Trading is Booming in India | Says Zerodha CEO Nithin Kamath

- Which is the Safest Car in India?| 1 Safest Car? | New Tata Safari.

- Good News| How to apply for a Narendra Modi loan? 2025

- Is Housefull 5 Hit or Flop?| Housefull 5 a Blockbuster?

The Risk Factor

While options trading offers potential for high rewards, it comes with high risk also, especially for beginners. Losses can mount quickly if the market moves against the trader’s position.

According to SEBI, over 93% of retail traders in options lose money, do not do option trading specially option Buy without proper knowledge.

Education is Key

Kamath and other experts believe that investor education is crucial. Initiatives like Zerodha Varsity aim to provide free learning content on trading and investing to help users make informed decisions. Without proper knowledge your fund will be washout so please take proper education from SEBI register Trainer.

Conclusions

The options trading boom in India is a reflection of a new generation’s interest in the financial markets. While the growth is impressive, it also comes with challenges. As Nithin Kamath rightly says, traders must balance enthusiasm with education and risk management.